Business Loan

- Home

- Business Loan

Business Loan (SME)

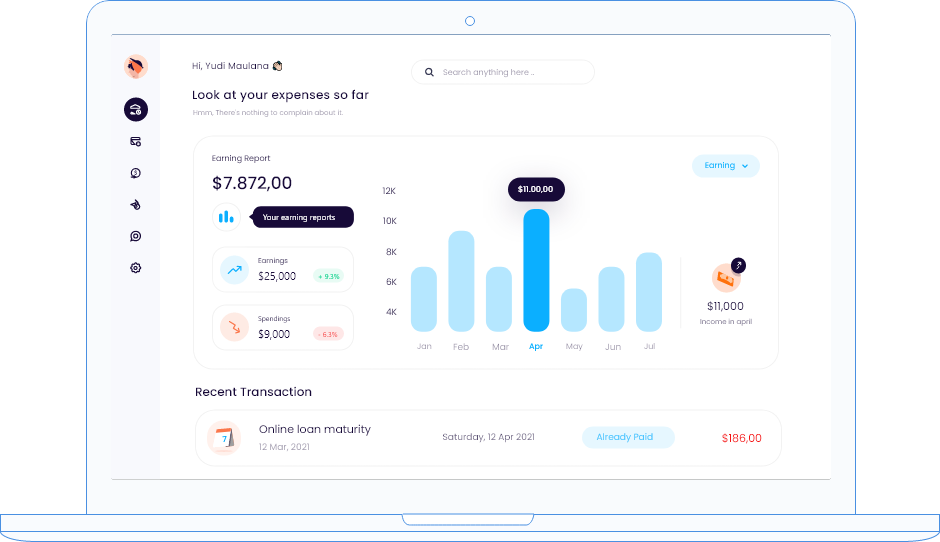

At Jesse Remedies, we understand the challenges faced by small and medium-sized enterprises (SMEs) when it comes to obtaining the necessary funding for growth and expansion. Our Individual Loan (SME) service is specifically designed to provide SMEs with the financial support they need to thrive.

Why Choose Our Business Loan (SME) Services?

Flexible Loan Options

We offer a range of flexible loan options tailored to the unique requirements of SMEs. Whether you need funds to start a new venture, expand your existing business, purchase equipment, or manage cash flow, our Individual Loan (SME) service can provide the capital you need.

Competitive Interest Rates

At Jesse Remedies, we believe in supporting SMEs by offering competitive interest rates that are favorable for your business. We understand that managing expenses is crucial for the success of your enterprise, and our loan terms are designed to help you achieve your financial goals while keeping costs manageable.

Fast Approval Process

We understand that SMEs often require quick access to funds to seize opportunities or overcome unforeseen challenges. With our fast approval process, you can expect a prompt evaluation of your loan application and receive a decision within a short period. Our streamlined process ensures minimal paperwork and enables you to get the funds you need when you need them.

Flexible Repayment Terms

We recognize that cash flow can fluctuate for SMEs, and we offer flexible repayment terms to accommodate your business's financial situation. Our loan experts will work closely with you to determine a repayment plan that aligns with your cash flow and ensures that you can comfortably meet your loan obligations.

Dedicated Loan Experts

Our experienced loan experts are here to guide you throughout the loan process. From application to disbursal, our team will provide personalized assistance and address any questions or concerns you may have. We are committed to ensuring that you have a smooth and hassle-free loan experience with us.

Transparent and Honest

Transparency and honesty are at the core of our business values. We believe in providing clear and concise information about our loan terms, fees, and charges. You can trust that there will be no hidden costs or surprises. We are committed to fostering a transparent and trustworthy relationship with our SME clients.

Apply for Salary Earner Loan

Need urgent loan for financial needs ? Applying for our Public Sector Loan (Salary Earner) is simple. Visit our loan application page and provide the necessary details. Our loan experts will review your application promptly and guide you through the next steps.

Loan Application Process

Applying for our Business Loan is simple and convenient. Follow these steps to get started:

Online Application:

Visit our website and fill out the Loan application form. Provide accurate and complete information to expedite the loan approval process. Upload the necessary documents, such as proof of identity, employment verification, and any additional documents requested by our team

Loan Evaluation:

Our loan experts will review your application and documents, assessing your eligibility and loan amount based on the provided information

Approval and Disbursement:

Upon approval, you will receive the loan agreement detailing the terms and conditions. After signing the agreement, the funds will be disbursed to your designated bank account.

Eligibility Criteria

To be eligible for our Business Loan, you must meet the following criteria:

Employment:

You must be currently employed in the public sector, with a stable job and a regular monthly income.

Age:

You should be at least 21 years old and not exceed the maximum age limit set by Jesse Remedies.

Proof of Identity:

You will need to provide valid identification documents, such as a national ID card, passport, or driver's license.

Credit Worthiness:

While a good credit history is not mandatory, a positive credit score may enhance your chances of loan approval.

Employment Verification:

We may require employment verification documentation, such as a salary slip, employment contract, or confirmation letter from your employer.

Business Loan Company in Lagos

At Jesse Remedies, we are dedicated to supporting the growth and success of SMEs. Let us be your trusted financial partner. Apply for an Business Loan (SME) today and unlock the potential of your business.